Services

ESAAC delivers tailored services by harmoniously integrating Shariah values with strategy, innovation, and technology—from concept to realization. We manage each engagement carefully to enhance and enrich our clients’ enterprises.

With our global Shariah and management expertise, we deliver innovative yet standardized solutions that generate enduring value. These specialized capabilities are always available to our clients—arming them with sustainable advantages at any moment, anywhere globally.

Our Expertise

Our Full Service Spectrum

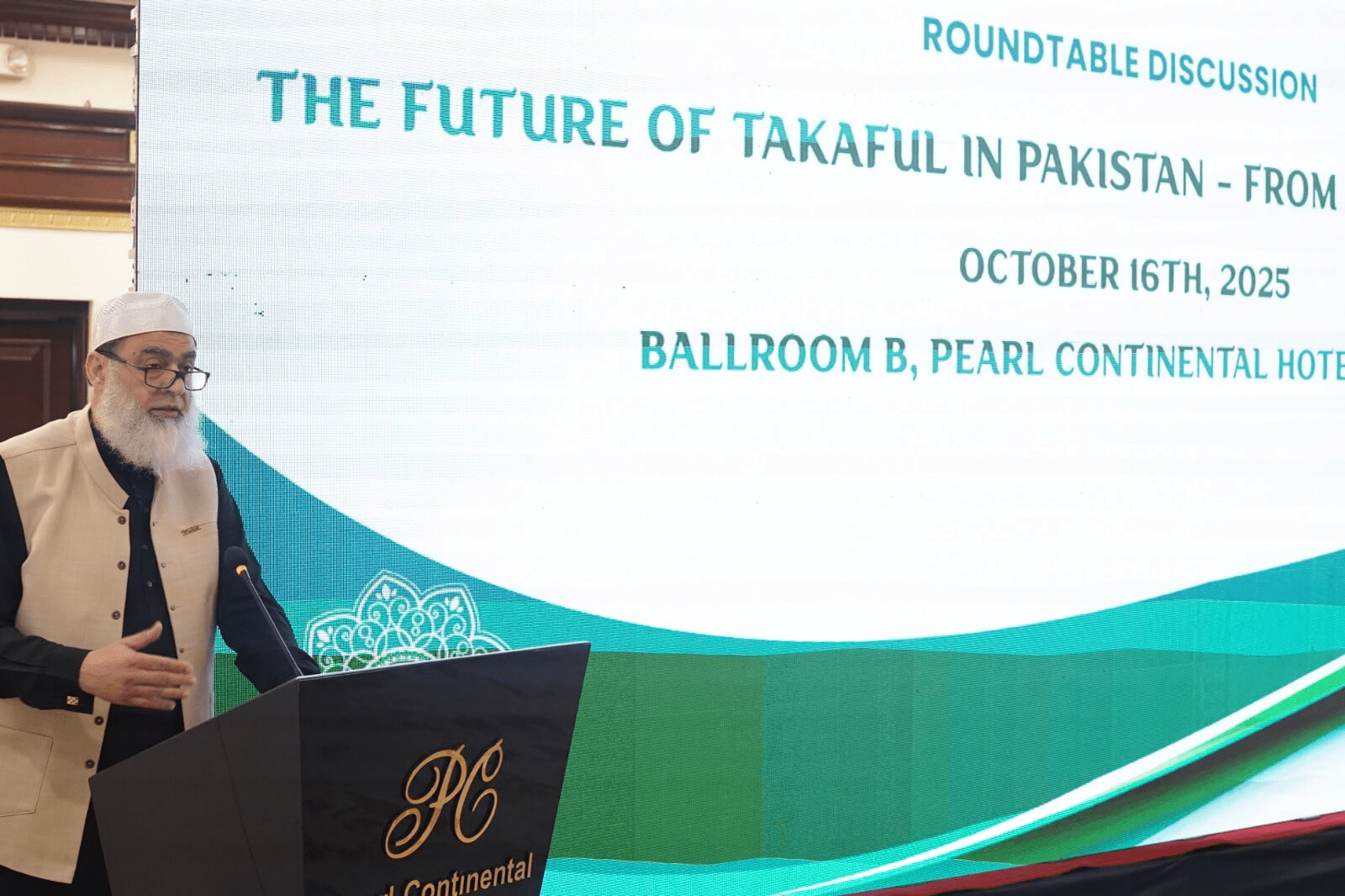

We at ESAAC provide a full spectrum of niche services for establishing and developing Islamic financial operations in different industries—including central banks, commercial banks, capital markets, Islamic banks, Takaful and Re-Takaful operators, asset management companies, and Modaraba companies.

Our one-stop turnkey facility allows institutions to start and operate Shariah-based businesses with ease. Our services include:

- Islamic Regulatory Framework Development

- Policy & Procedures Design

- Shariah Advisory & Supervision

- Manual & Standard Operating Procedures

- Product Development & Management

- Shariah Audit & Compliance

- Sukuk Advisory & Certification

- Legal Documentation & Structuring

- Risk Management Services

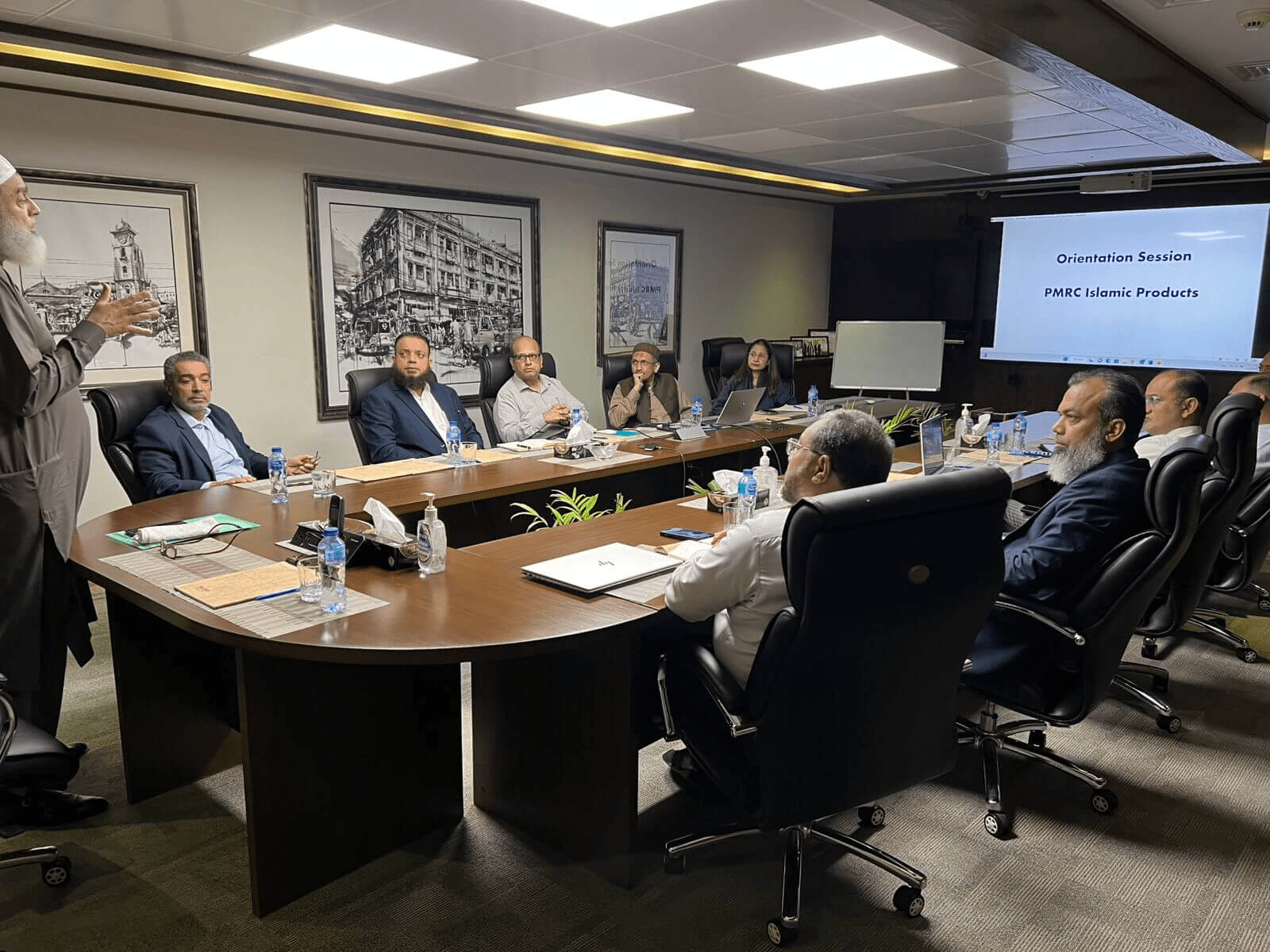

- Training, Certification, and Capacity Building

- Research & Development

Going beyond institutions, ESAAC now also offers Islamic Wealth Management services for High Net-Worth Individuals (HNIs). We advise HNIs, corporates, and multinationals to invest in Halal using customized advisory and stock screening services, maintaining portfolios profitable and

Shariah-compliant—enjoying pure Halal income confidently and transparently.

With ESAAC, you gain access to one-window Shariah-compliant financial excellence, whether you are an institution seeking to establish Islamic operations or an individual investor seeking ethical appreciation of wealth.